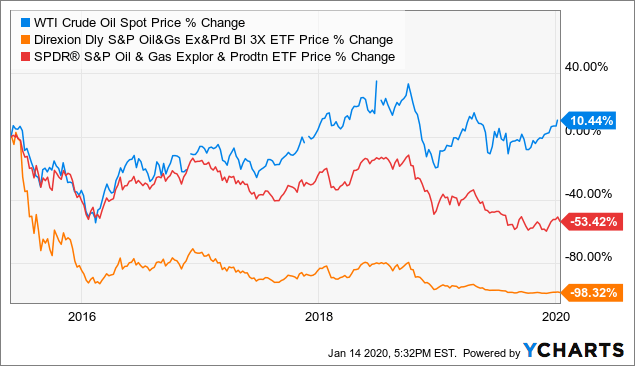

The energy sector as measured by the energy select sector spdr etf has dramatically underperformed the broader market with a total return of 34 7 over the past 12 months compared to the s p.

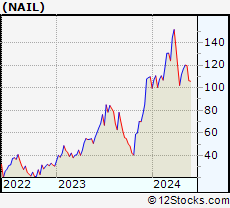

Energy sector 3x etf.

The largest energy etf is the energy select sector spdr fund xle with 9 33b in assets.

The energy spdr has more assets under management than any other energy sector etf and its portfolio of energy stocks spans the entire industry.

Click on the tabs below to see more information on leveraged energy etfs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

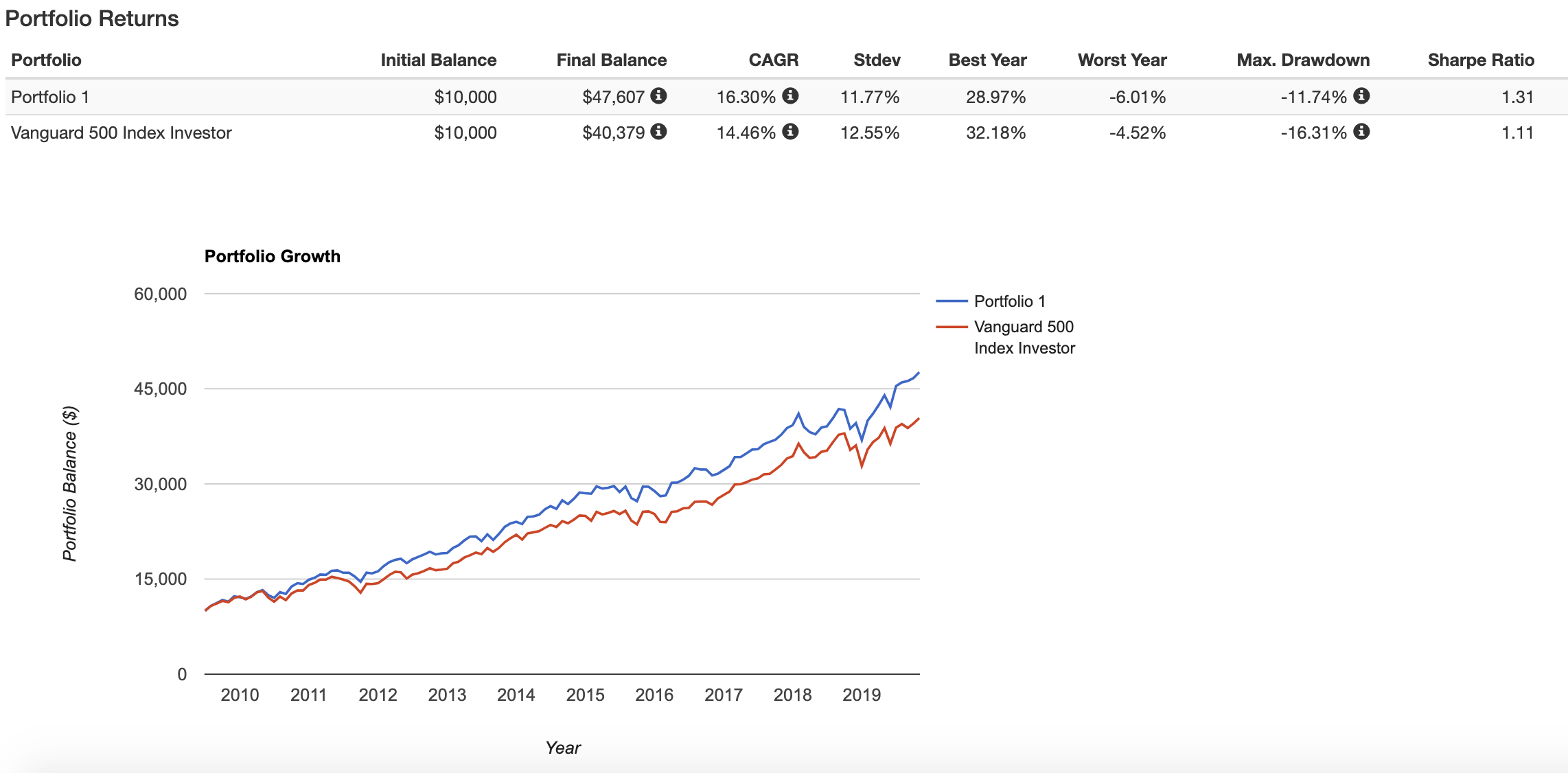

Etfs which are available to individual investors only through brokers and advisers trade like stocks on an exchange.

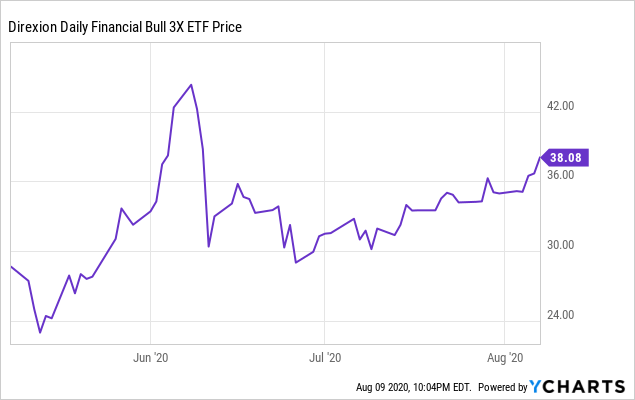

Equity sector etfs are popular among investors who want targeted exposure on a sector by sector basis including energy financials health care technology utilities and more.

By default the list is ordered by descending total.

In the last trailing year the best performing energy etf was the drip at 399 21.

It divides its assets across 28 different countries.

Click on an etf ticker or name to go to its detail page for in depth news financial data and graphs.

An exchange traded fund or etf is an investment product representing a basket of securities that track an index such as the standard poor s 500 index.

The energy sector is a category of stocks that relate to producing or supplying energy i e oil and gas drilling and refining or power utility companies.

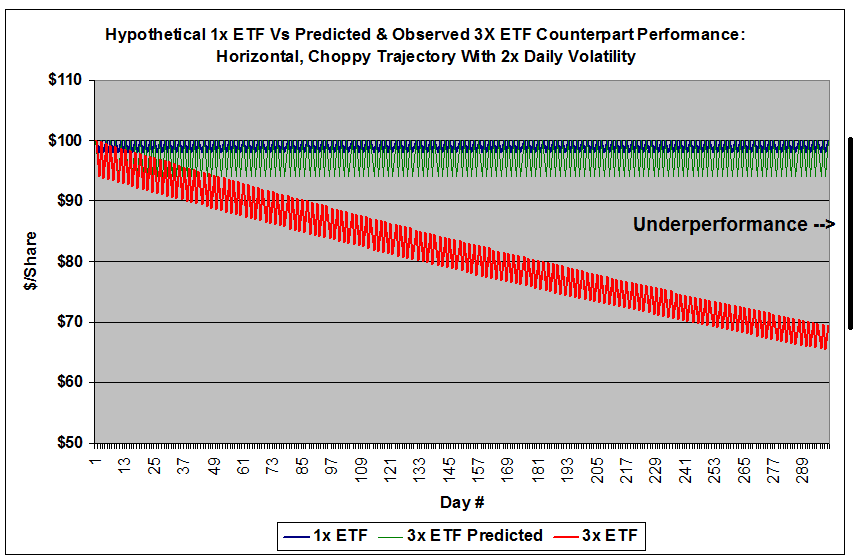

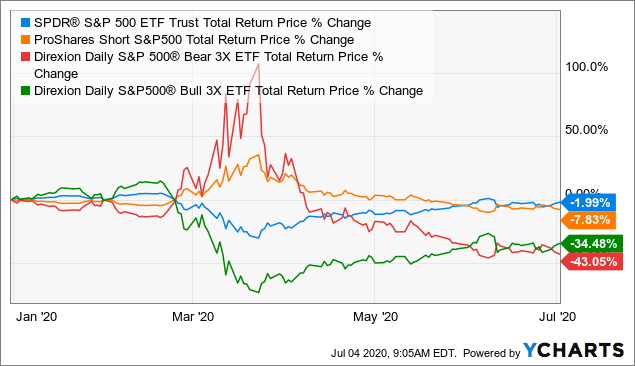

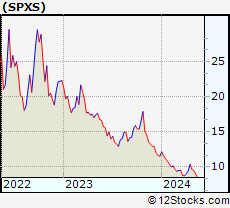

The level of magnification is included in each fund s description and is generally 2x or 3x or 2x or 3x.

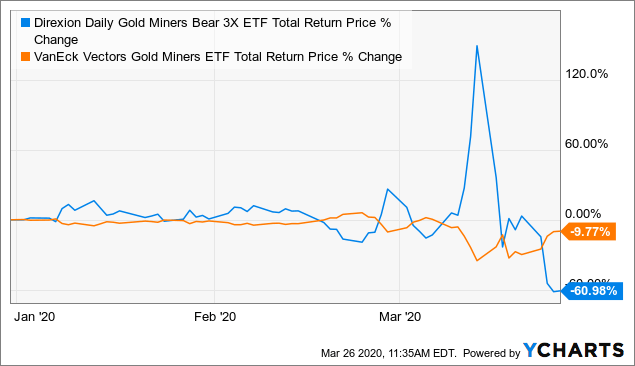

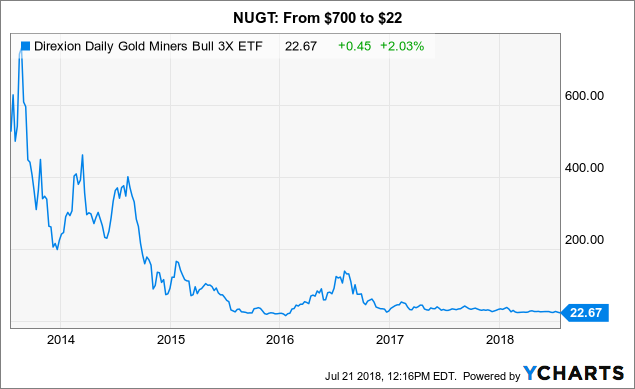

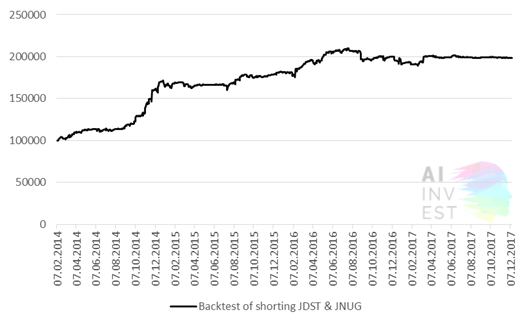

More double gold etf.

Click on the tabs below to see more information on leveraged 3x etfs including historical performance dividends holdings expense ratios technical indicators analysts reports and more.

Leveraged and inverse equity sector etfs.